inheritance tax changes budget 2021

The deadline for submitting your self-assessment tax return is normally 31 January. - Gifts worth less than an annual gift allowance of 3000 which each person can give free of inheritance tax per tax year.

Irs Budget And Workforce Internal Revenue Service

The specific amount depends on your filing status and changes each year.

. 1 Income Tax Changes in Union Budget 2021. Mitigating IHT on property growth 944 AM 2nd October 2020 About 2 years ago 0. Taking your pension.

3 How to use the Income Tax Calculator India for FY 2021-22 AY 2022-23. Find a Local Office. Whats NewNew Jersey Estate Tax Changes Accessed Nov.

Get a list of states without an estate or inheritance tax. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. THE INHERITANCE TAX IHT nil-rate band would be at about 460000 today if it increased in line with inflation - but instead it falls behind at.

2 lakh for the interest on the home loan. To learn more about this new filing. 2013 under Ohio budget laws.

Buying and running a car. INHERITANCE TAX will bring in an extra 13billion for the Treasury it has been predicted as inflation pushes more families into the tax. Tax Saving - How to Save Income Tax For FY 2022-23.

For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Notable Ranking Changes in this Years Index Florida. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706PDF.

How it works what you might get National Insurance. If you did a paper return youll receive it by post. New Jersey phased out its estate tax in 2018.

The lifetime exemption is 117 million for the 2021 tax year and goes up to 1206 million in 2022. Tax Deductions Chapter. The Estate Tax is a tax on your right to transfer property at your death.

And that has led one financial expert to say that inheritance tax IHT is no longer the preserve of the rich. For the 2021 tax year seniors get a tax deduction of 14250 this increases in 2022 to 14700. Improving Lives Through Smart Tax Policy.

For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. Terms and conditions may vary and are subject to change without notice.

This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Loss from Home Loan Interest. Continue reading Personal Allowance.

15 lakhs tax saving mutual funds ELSS PPF NPS 80CCD 80D. Section 80D also offers for investments Rs. We may from time to time expand or reduce Our.

How to budget find the best deals and switch to save money. Prior to the introduction of Estate Duty by the Finance Act 1894 there was a complex system of different taxes relating to the inheritance of property that applied to either realty land or personalty other personal property. So for the 202122 tax year which ended on 5 April the deadline will be 31 January 2023.

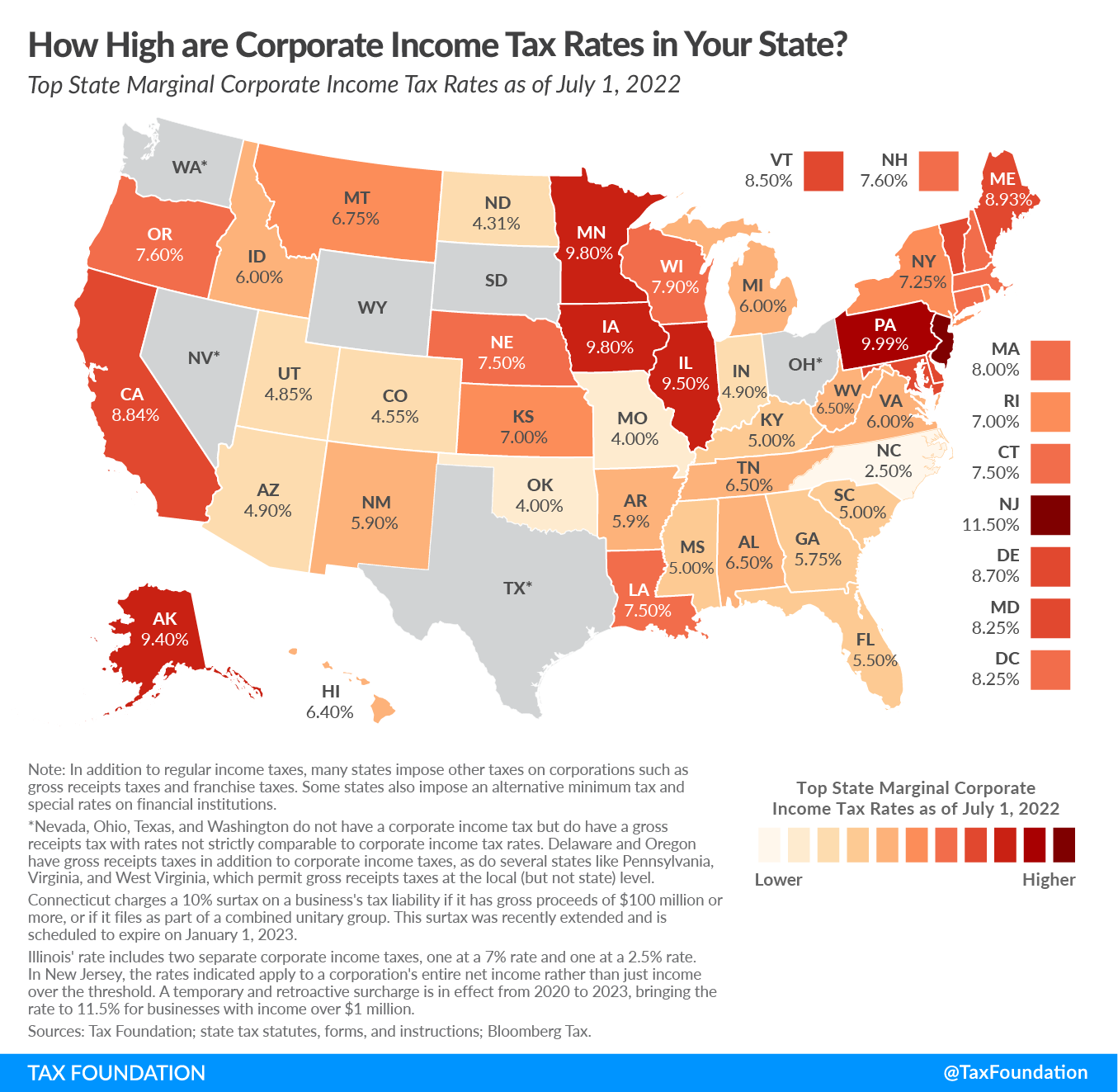

Floridas corporate income tax rate declined from 55 to 44458 percent in September 2019 effective for tax years 2019-2021. Tax Saving is the best options for investment like Section 80C offers Rs. The government has published the personal allowance for 202122 on its website and as such has confirmed that it will increase by the increase in the Consumer Prices Index for September 2020 which stood at 05.

What happens after Ive filed my tax return. Filing a gift tax return doesnt mean youll actually end up paying gift taxes as the IRS also has a lifetime exemption for the total amount someone may gift throughout their lifetime before they pay gift taxes. Put simply if you have a pension fund and you nominate your heirs to get the money if you die before you use it they will receive the whole amount tax-free.

From 1694 Probate Duty introduced as a stamp duty on wills entered in probate in 1694 applying to personalty. The 3000 can be given to one person or split between several persons. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

Taking the standard deduction is often the best option and can eliminate the need to itemize. Effective May 2 2018 estate representatives responsible for filing an estate tax will be required to register for an account file and submit payment via MyTaxDCgov. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

Major changes in the rules on the inheritance of pensions came into force on 6 April 2015. 75000 and section 24 claims deduction up to Rs. 2 Download Income Tax Calculator in Excel.

Once youve filed your return youll get your tax bill. It was announced in the Finance Bill 2021 that inheritance tax nil rate bands will remain at existing. From 1780 Legacy Duty an.

When youre over 65 the standard deduction increases. 11580000 in 2020 11700000 in 2021 and 12060000 in 2022. 1335 PM 23rd April 2021 About A year ago 0.

The inheritance tax threshold above which tax is charged at 40 per cent has been frozen at 325000 since 2009 and will remain the same until at least 2026. Terms and conditions may vary and are subject to change without notice. What Happens If Our Business Changes Hands.

The personal exemption for tax year 2021 remains at 0 as it was for 2020. The Office of Tax and Revenue OTR has made changes to the estate tax filing process for representatives of decedents whose death occurred from January 1 2016 and forward. With the approval of the Law 112020 of 30 December on the General State Budget for 2021 the second section of the sole article of Royal Decree-Law 132011 of 16 September which re-established the Wealth Tax on a temporary basis is repealed and the indefinite nature of the wealth tax is re-established although a different measure may.

Complaints financial help when retired changes to schemes. Income from other sources. The personal allowance is the amount of money that each person can earn before paying tax on their earnings.

Added Irs Funding Would Help Ensure High Income Households Businesses Pay Their Taxes Center On Budget And Policy Priorities

Pa Corporate Tax Cut Details Analysis Tax Foundation

Biden Budget Biden Tax Increases Details Analysis

Scott S Skin In The Game Plan Could Raise Taxes By 100 Billion In 2022 Mostly On Low And Moderate Income Households

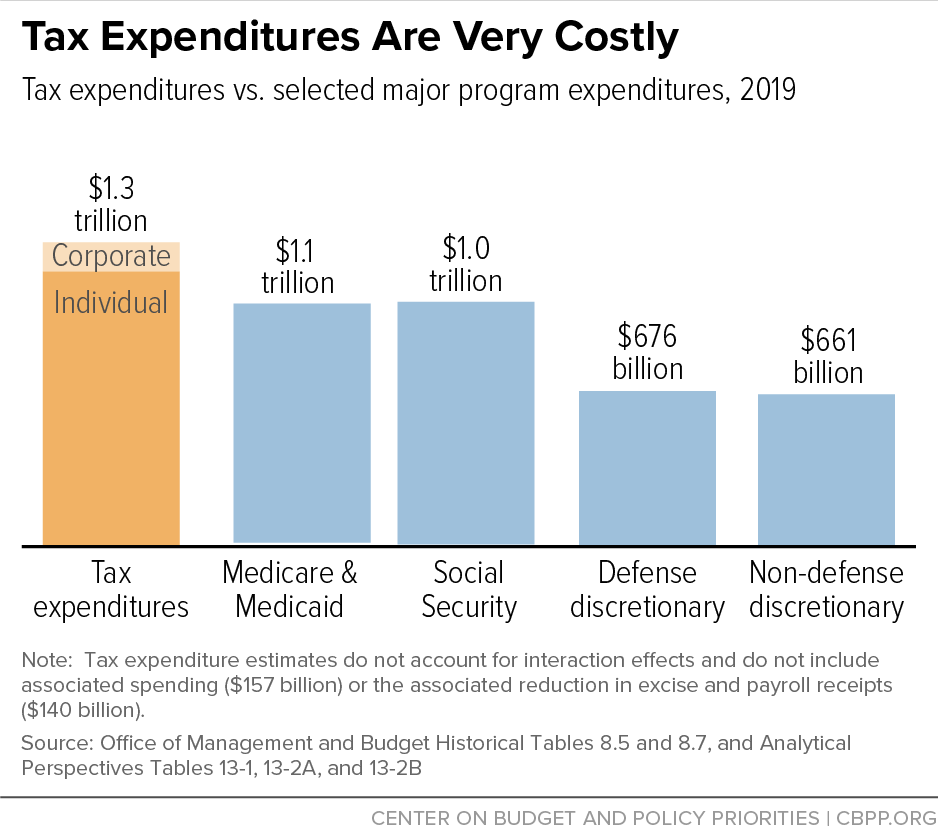

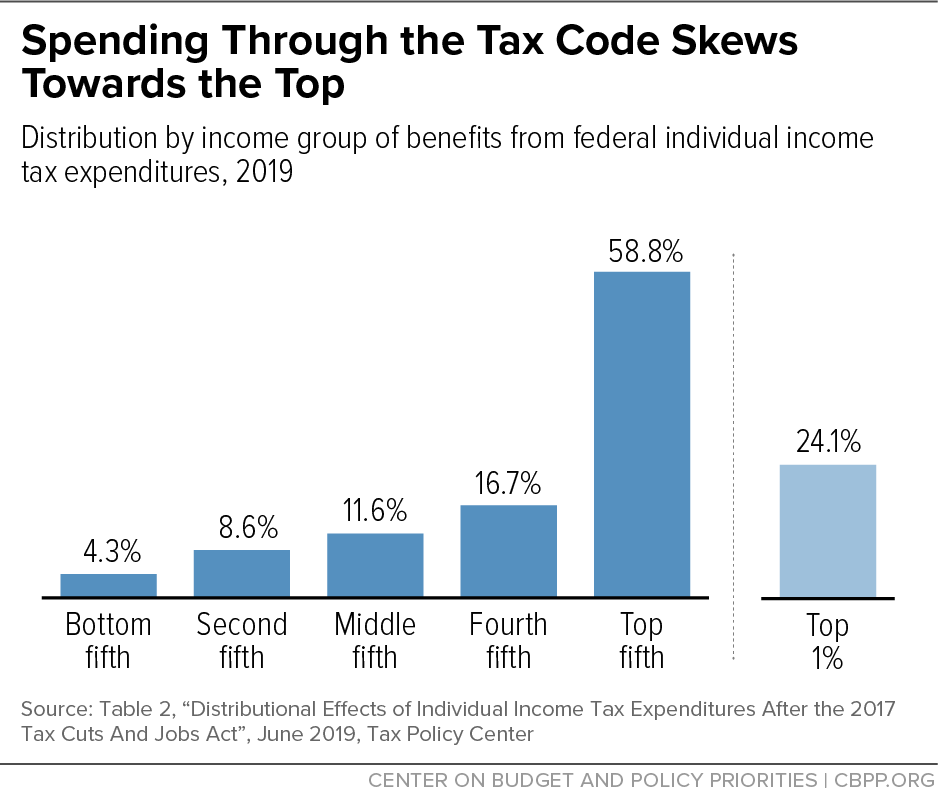

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

What Is The Tax Expenditure Budget Tax Policy Center

Fbr Capital Gain Tax On Property In Pakistan 2021 22 In 2022 Property Finding Yourself Capital Gains Tax

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

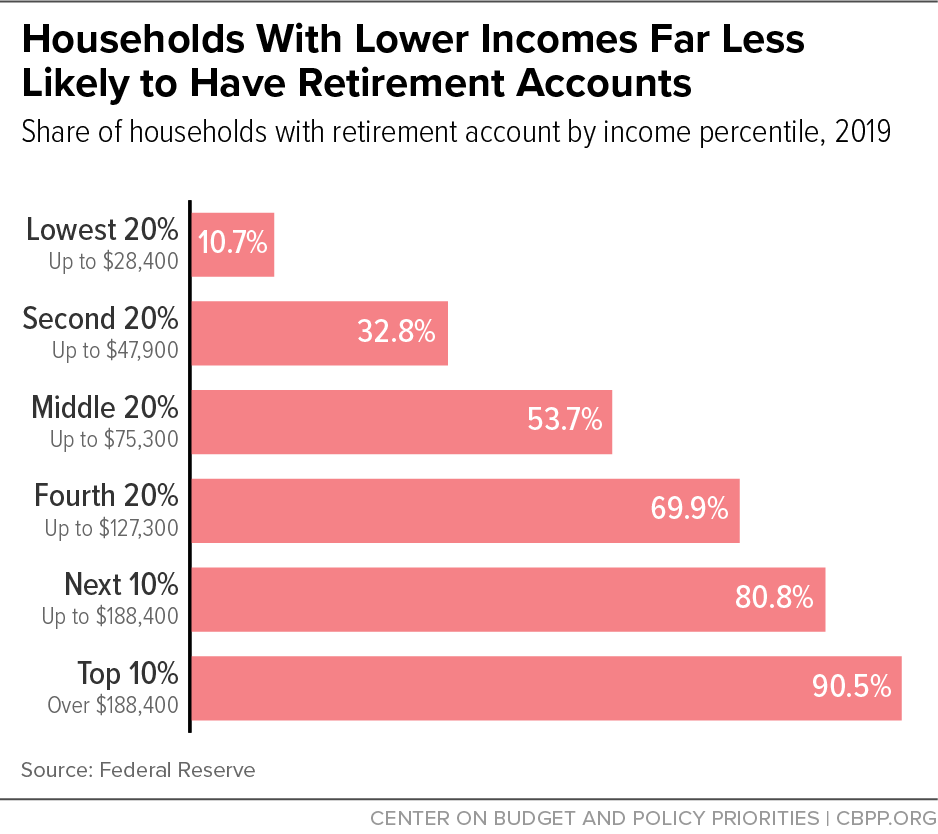

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

What My New 1257l Tax Code Means And Full List Of Hmrc Changes For 2021 22 Inews Inheritance Tax Tax Refund Money

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

New 2021 Irs Income Tax Brackets And Phaseouts Tax Brackets Income Tax Brackets Irs Taxes

100 00 For Btc 12 Months Away The 100 Blockchain Electronic Products

4 Dave Ramsey Rules We Broke And Still Paid Off 71k Of Debt Easy Budget Budgeting Debt Simple Budget

Key Information About Inheritance Tax Iep Financial Inheritance Tax Inheritance Financial News

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance Irs Taxes Tax Table Tax Brackets

The U S Deficit Hit 984 Billion In 2019 Soaring During Trump Era The Washington Post